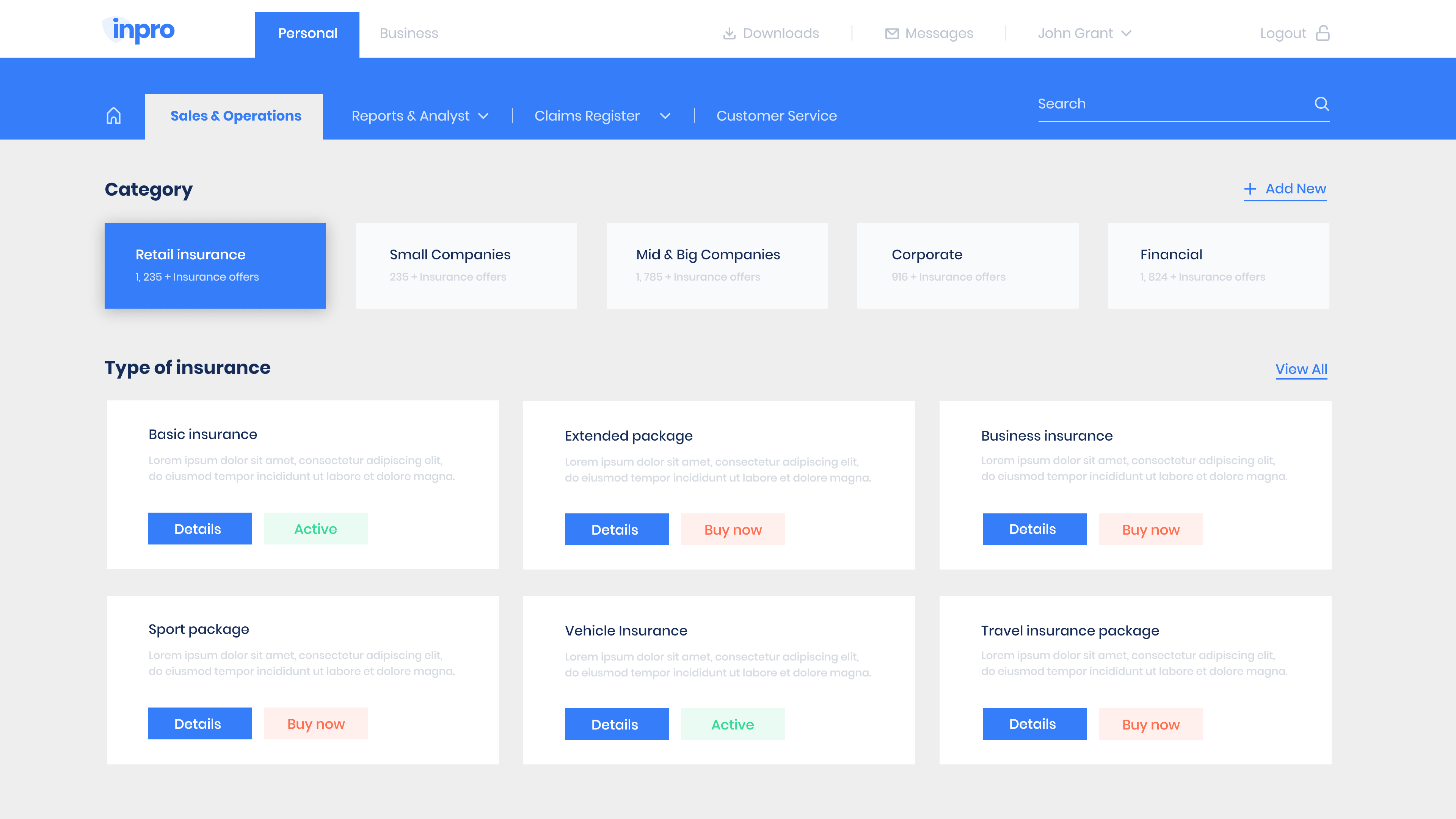

What’s wrong with insurance services?

Regardless of whether you are a company or an individual, the process of getting insurance is associated with a lot of document signing, data verification, and waiting. Customers often aren’t aware of what their actual options are and types of policies they can buy. What’s more, customer service doesn’t always work flawlessly hence the flow of information may not be as effective as it should be.

As a result, the process of insurance claim reporting requires a lot of effort and patience. Not to mention, it’s very often unclear on what condition a claim has been rejected or accepted by agents. On the other hand, insurance companies and brokers spend a lot of time verifying received insurance applications and preparing suitable documents. Where in fact, all of these could be done via an online platform ensuring transparency and ease of communication.